“Work from home!”

“Earn $1,000 a week working one hour a day!”

“Make money while you are on vacation!”

Too Good To Be True?

Shakes, candles, leggings, vitamins, and makeup are just a few examples of direct sales products marketed as “start your own business” ventures. With promises of top earners winning extravagant vacations and living a fabulous lifestyle, each year thousands of people flock to these businesses thinking they are an easy way to embark on entrepreneurship.

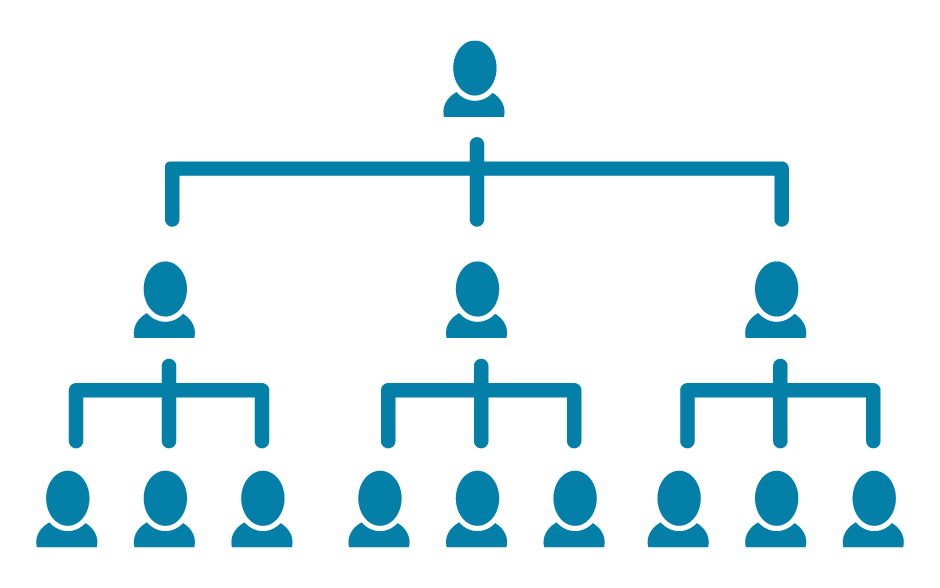

Commonly referred to as multi-level marketing companies (MLM’s), these companies create sales teams and encourage (if not require) you to build your own “downstream” team, so you can earn a percentage of their sales. Chances are you will also be someone’s “downstream”, and a percentage of your own sales will go to someone else. This is where the term “multi level” comes from. While often touted as affordable start-up businesses, it is common for these companies to require you to spend money up front to attend trainings and/or purchase start-up inventory ranging from hundreds to thousands of dollars.

Other common requirements are monthly product purchase requirements, which can leave you sitting on hundreds if not thousands of dollars in inventory. You may also encounter strict marketing requirements that prohibit you from certain types of marketing. You may not be allowed to sell any other similar products, and you may be required to form an LLC and/or carry a certain level of liability insurance.

Like most things, there are pros and cons to MLM’s and it is important to understand them before you take on a venture.

- It’s important to do your homework, as some of these businesses are rated more highly than others.

- Be clear about your goals and how much money you feel comfortable putting at risk. Are you looking for a small side hustle to earn a little extra cash, or are you looking to replace your full-time job? Typically, banks will not finance these types of businesses with a traditional business loan so any start-up costs will be out-of-pocket for you.

- Before signing any contracts, have an attorney review the documents and explain to you in plain language what the company is expecting of you.

- Do you have a large network of family and friends who will make routine purchases, or will they block you on Facebook when you start advertising?

Finally, as the old Yankee saying goes: if it sounds too good to be true it usually is. A study by AARP found that only 25% of these businesses actually turn a profit – and over half of that profit was under $5,000*.